by E. J. Antoni

Are you wondering why checking out at the grocery store these days feels like making a mortgage payment? This week’s four-decade-high inflation is a direct result of the Federal Reserve taking its eye off the ball over the last two years. Instead of focusing on its mandate of keeping prices stable, it has been more concerned with financing massive federal deficits and kowtowing to liberal ideology.

But now the Fed chair is claiming just the opposite.

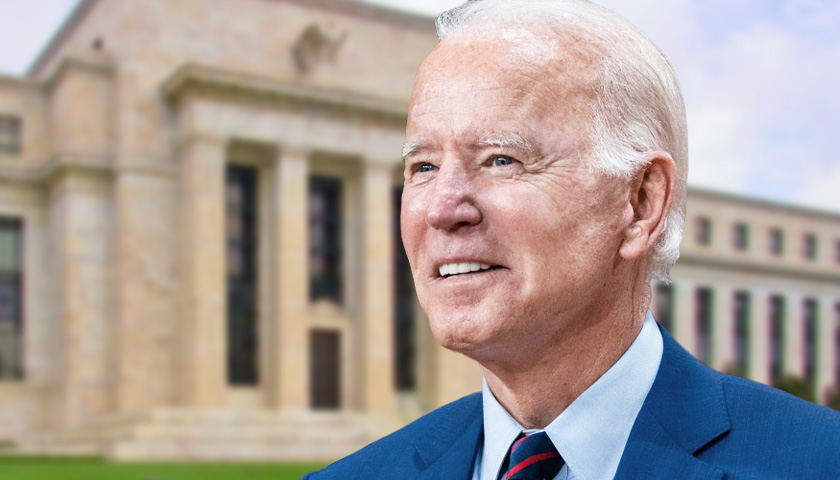

Chairman Jerome Powell recently said in Stockholm that the Fed must avoid politics to maintain its independence, which is absolutely true. But it is the opposite of what the Fed has done under President Joe Biden.

Powell and other Fed members have routinely opined about climate change, diversity, equity and other left-wing talking points — all while they called inflation transitory. Powell opened Pandora’s box as soon as he jeopardized the Fed’s independence with these political talking points.

The recent change in tone from Powell would be welcome if it did not have the hollow ring of rhetoric behind it. The Fed chair rightly said, “Without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals.” He continued, “We are not, and will not be, a ‘climate policy maker.’”

And yet, that is precisely what is going on at the Fed, which has proposed a new rule related to banks’ stress tests. That rule would penalize reliable domestic American energy while subsidizing “green” energy projects like solar and wind.

Part of the Fed’s regulatory role is to test the systemic risks that individual financial institutions pose to the entire market. This function is deemed necessary because of the interconnected and circuitous nature of modern finance. These stress tests are supposed to evaluate the likelihood that an asset will be worth its anticipated value, and what ramifications will stem from that asset not being worth its anticipated value.

For instance, if a firm is heavily invested in junk bonds, which have a high default risk, and the coupon payments, or future income from those bonds, have been pledged by the firm as collateral for leveraged investments, that firm is in a relatively risky position. Furthermore, it can pose risks to other financial firms, either by firms investing directly in one another or by creating systemic troubles.

Anything that causes a systemwide liquidity crunch risks creating a flight to liquidity, where investors dump nonliquid holdings in exchange for cash. That simultaneously creates a cash shortage and devalues nonliquid assets. Firms which are leveraged and rely on the value of those assets could now also be put at risk, and the trouble spreads.

Thus, a single domino can cause many others to fall.

But the Fed’s proposed regulatory rule on climate change will essentially consider “green” investments to be safer than their actual financial position, while conventional, reliable energy sources will have a risk premium. That incentivizes investment in wind and solar, effectively creating a subsidy, while penalizing investment in coal, oil, and natural gas.

The systemic effect is far more insidious — and scarier. Risky “green” investments will be used to offset other risky investments in a firm’s portfolio. In other words, what should be seen as a doubly risky position will be viewed by regulators as balanced.

That is like saying there’s no risk to drinking and driving, provided you are also speeding.

The Fed is betraying its regulatory role, building the foundation of the very kind of crisis it is supposed to prevent. That is why I, and many others, are responding to the Fed’s request for regulatory comments on its proposal.

If regulators cannot address the serious consequences of these imprudent regulations, then the implementation of said regulations may be prevented.

For the sake of the Republic, people must reject the woke agenda of the radical left. This is especially true for the Fed, an institution whose apolitical nature should be sacrosanct, contrary to the Biden administration’s aim to use every aspect of government to force its will upon Americans.

The inner workings of the Fed are mysterious to almost everyone, in the same way the Wizard of Oz was mysterious to Dorothy.

And as the Fed moves to regulate energy investment while Powell says the opposite, it is reminiscent of the “wizard” telling Dorothy, “Pay no attention to that man behind the curtain!”

– – –

E. J. Antoni is a research fellow for regional economics in The Heritage Foundation’s Center for Data Analysis and a senior fellow at Committee to Unleash Prosperity.

Photo “Joe Biden” by The White House. CC BY 3.0 US. Background Photo “Federal Reserve” by Rdsmith4. CC BY-SA 2.5.